Access a clear view of the best funding options. We match you with low rates and favorable terms in minutes. **No impact on your credit score.**

Use our simple calculator to see estimated monthly payments based on typical terms we secure for businesses like yours.

Estimate Your **Monthly Payment**

$4,442.44Answer a few basic questions quickly and securely. This check will have no impact on your credit score.

Our technology instantly matches you with pre-qualified options from our network of top lenders.

Choose the best offer, finalize the details, and receive your funds—often within 24-48 hours.

At Vantage Business Loans, we believe finding the right capital requires **market insight and a clear strategy.** We provide the data and support you need to make the optimal decision.

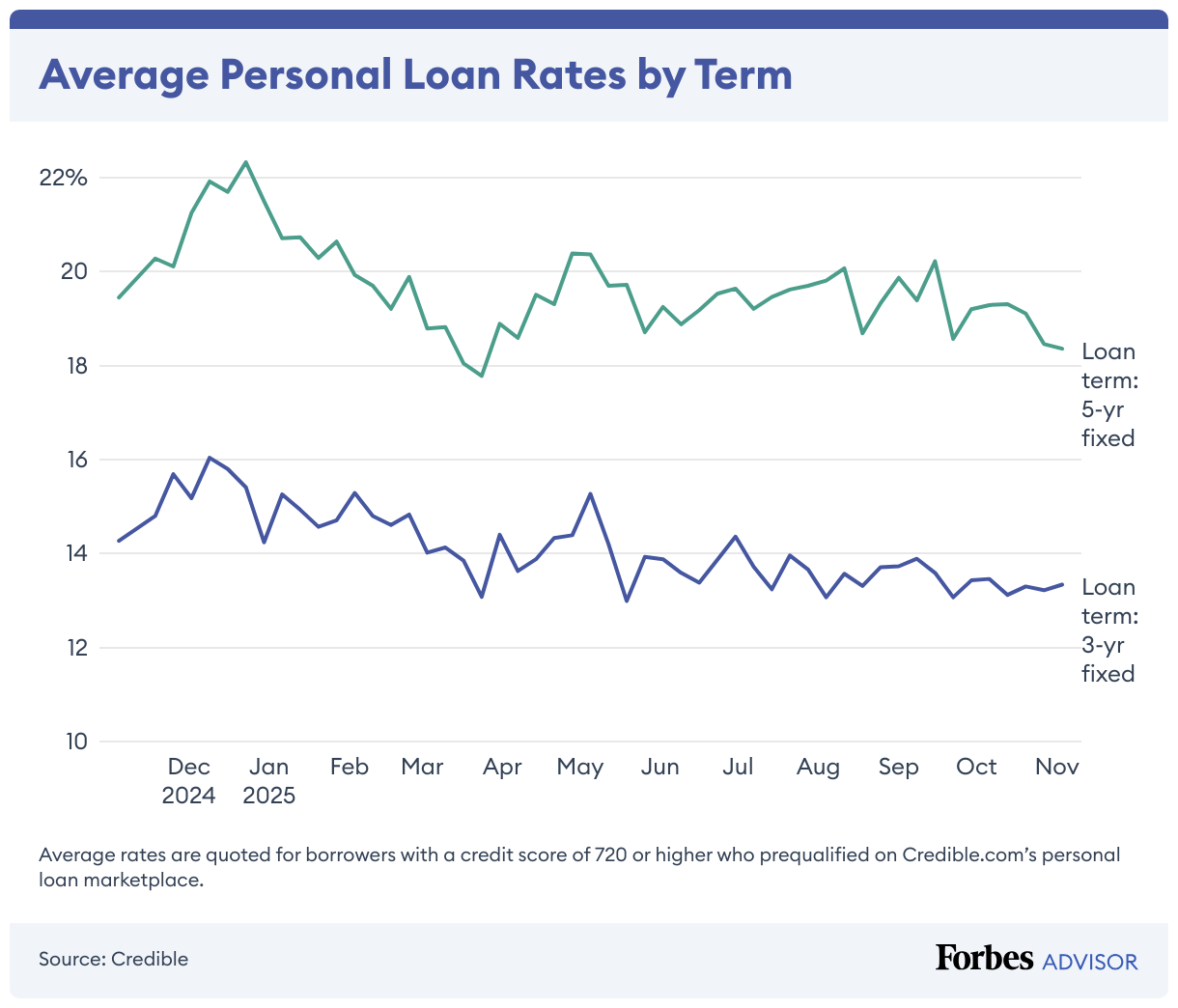

The national average APR for business financing can range dramatically, often soaring from **14% to over 99%** for online and high-risk loans. Even with good credit, a difference of just 5% can cost your business tens of thousands over the life of a loan.

Don't settle for the first offer. We give you the market view needed to avoid costly mistakes.

We level the playing field. Our technology connects you to a vast network of **50+ lenders** at once, from traditional banks (offering lower **6.7% - 11.5%** APR) to specialized alternative financiers.

By comparing offers side-by-side, we give you the power to:

Explore the diverse funding types we can match you with:

Get a **lump sum of capital** with clear, fixed repayment terms. Perfect for major investments, expansion, or consolidating debt.

Access **flexible, revolving credit** you can draw from, repay, and reuse. Ideal for managing cash flow, unexpected expenses, or seizing opportunities.

Benefit from **government-backed loans** offering some of the lowest interest rates and longest repayment terms available. Great for established businesses seeking significant capital.

Secure **fast capital** with repayment tied directly to your daily or weekly sales. A flexible option for businesses with consistent revenue but limited collateral.

Michael J., Restaurant Owner

"Vantage helped us get the working capital we needed in less than 48 hours. The process was fast and straightforward—no surprises."

Sarah K., E-commerce CEO

"The rate comparison tool saved us thousands. We found a line of credit that was 4% lower than what our bank offered."

David P., Construction Firm

"Our dedicated advisor was essential. They walked us through the SBA application and helped secure a long-term facility."

Jessica L., Marketing Agency

"Needed capital to hire staff quickly. Vantage made the funding process incredibly fast and transparent. Highly recommended."

Robert B., Logistics Manager

"After being denied by our local bank, Vantage found a term loan that perfectly suited our revenue cycle. True strategic partners."

Generally, you should be in business for at least 6 months and have a minimum monthly revenue of $5,000. Requirements vary by lender and product type.

No. Our initial pre-qualification process only requires a "soft pull" which does not negatively impact your credit score.

For certain products, funding can be completed in as little as 24 hours after final approval.